Trickler

“Trickle down”, “Trickle Up”. Ever wonder who came up with the phrases? Will Rogers. He originated the terms, “trickle down” and “trickle up” back in the 1920s, and was one of our inspirations for the Trickler. The Trickler lets you see how your pay and society would change in a more equal or less equal US.

“Trickle down”, “Trickle Up”. Ever wonder who came up with the phrases? Will Rogers. He originated the terms, “trickle down” and “trickle up” back in the 1920s, and was one of our inspirations for the Trickler. The Trickler lets you see how your pay and society would change in a more equal or less equal US.

Here’s how Will coined it back in the day.

“The money was all appropriated for the top in the hopes that it would trickle down. to the needy. President Hoover didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellow’s hands.

All one had to do was look at what happened to the money loaned to the railroads and smaller banks. They had not used it to create jobs. Instead, they paid off their loans to the New York banks. So the money went uphill instead of down. You can drop a bag of gold in Death Valley, which is below sea level, and before Saturday it will be home to papa J. P. Morgan”.

If you don’t know who J. P. Morgan was, he, basically, ran American industry in the early part of the 20th century. Today, he has no equivalent. We looked around for an equivalent to Will Rogers to get the latest chapter in the trickle story, and we found this guy Stephen Colbert. Maybe you’ve heard of him?

Before watching Steve’s video, please take note of our disclaimer. We’re independent and entrepreneurial, not political. We also love super earners, earners and the unemployed equally, and believe we’re all in the same economic boat, because what goes around comes back around again. So, by rowing together, we’ll all get to the shores of win-win faster.

Will got at a universal truth when he said, “Americans were saved by their good humor during hard times: the worse the situation, the more Americans laughed.” We would only add that we observe that this is true of people everywhere. In these hard times, it follows, then, that the more you’re feeling the heat, the more likely you are to find Steve’s satire funny. But, even if you’re in the top 3%, as he is, it’ll probably make you smile just the same.

Try the Trickler out at the bottom of the page. It’s set to an inequality temperature of 38, the lowest ever recorded in the US, which we hit back in 1968. But you can change it to whatever temperature you like (100 degrees means 1 person has all the pay and you have none, 0 degrees means everyone has the same pay). Enter your salary and click. If you’re like most people, you’ll see your salary rise at 38 (the US is at 46 now).

Play with it to find the temperature that works for you. It turns out that inequality, like body temperature has a systemic impact. It not only drives your pay, but GDP growth, savings rate, high school drop out rates, homicide rates and democracy. Openyear’s Open Pay will allow you to set your personal temperature to negotiate how pay is shared between people you influence and you.

After you click, you’ll be taken to an expanded version of the Trickler that displays your new pay in a more equal or less equal US, along with 5 gauges showing how conditions would change in the US in response to the change in inequality. Data for the gauges were drawn from the following sources:

Inequality, Growth and Poverty in the Era of Liberalization and Globalization

High Income Disparities Leads to Low Savings Rates

Why is Violence More Common Where Inequality is Greater?

Inequality and US High School Drop Out Rates

On the Relationship between Political Inequality and Economic Inequality: A Cross-National Study

Raise a glass of your favorite beverage (with lime) this Labor Day to remember all the earners who aren’t earning enough, or not earning at all. Or, better yet, invite them over and feed them. And, don’t forget to have a good laugh!

How to be Cooler

August 18, 2010 by Openyear

Filed under Sharing Economy

Last time, we broke down for you, “How to be a billionaire“. This time, we want to talk about something even more important, “How to be cooler”.

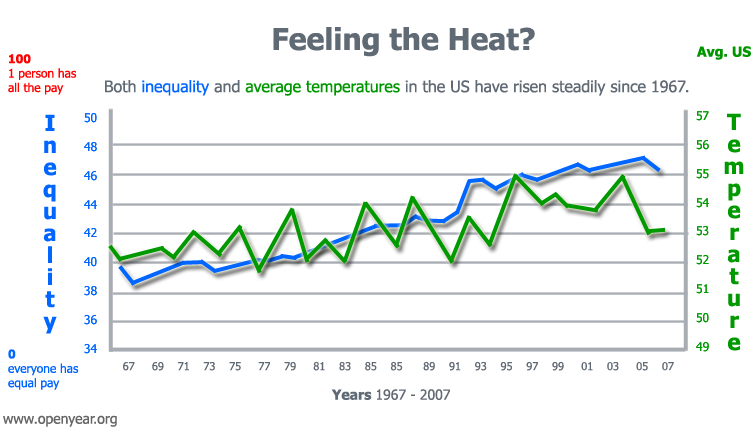

98.6 F. If you’re feeling well right now (and we hope you are), that’s very likely your body temperature. Everything has an ideal temperature range where it feels well and/or functions best. But, what is temperature anyway? It’s like a poll of molecules, that indicates the distribution of their speeds around the thermometer. Could their be an ideal pay-distribution temperature for your company or the US where it feels well and/or functions best?

Imagine a thermometer with 100 at the top and zero at the bottom. At 100, you’re broke. One person has all the pay, and it’s not you. At 0, everyone has the same pay as you. Well right now, that thermometer in the US is set at 46 for pay, and 85 for overall wealth. Maybe you’re feeling the heat with no raise, no job, or too much debt.

Now that 2 record highs are being set for every record low, maybe you’re feeling the heat outdoors too with heat waves, weirder weather or stronger storms. If it feels like we have a fever in the US, consider that it wasn’t always so. To get the flavor how it was, let us take you back to 1968, when things were much cooler.

|

|

|

’68 wasn’t the birth of the cool. That happened in 1957. But, you could say that’s when cool hit puberty. 2001: A space Odyssey was in the theaters. Steven Spielberg called it his film generation’s “big bang”. The band Led Zeppelin formed. They’ve been ranked the third best, and one of the most influential bands of all time, by Spin. Richard Pryor, ranked #1 stand up comedian of all time by Comedy Central, released his first recording, and quiped, “When you ain’t got no money, you gotta get an attitude.” Truer words are seldom spoken.

It was easier to find cool culture, and it was easier to find a cool breeze too. Why? Because the average US temperature was 52.1 degrees, as compared to 53.1 for 2009, the second hottest year on record, which ended the 2000s, the hottest decade on record. A 1 degree rise may not sound like much until you consider that for each 1 degree Celsius we go up, crop yields drop 10%, and the area burned by wildfires in the West goes up by much larger percentages. Drought is now persistent in the West. It covers 1/3 of the Continental US, and it’s spreading. Not cool if you’re a farmer or a rancher. Not cool if you like to eat.

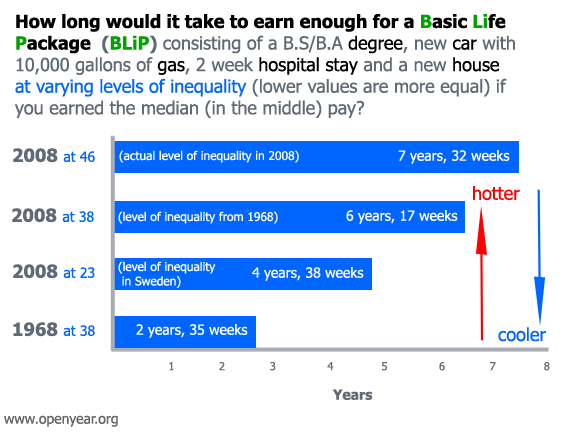

But, best of all, it was easier to find a good life, because the level of pay inequality was at a cooler 38, rather than where it is today, a hotter 46. To get a feel for what that would mean for you on a day-to-day basis, consider how long it would take you to earn enough to buy a Basic Life Package (BLiP). No one sells BLiPs yet, but we think someone should. Here’s what you’d get, 4 years of tuition towards a BS/BA degree, a new car with 10,000 gallons of gas to go with it (or equivalent electricity, if it’s a plug-in), 2 week hospital stay (just in case), and a new house.

But, best of all, it was easier to find a good life, because the level of pay inequality was at a cooler 38, rather than where it is today, a hotter 46. To get a feel for what that would mean for you on a day-to-day basis, consider how long it would take you to earn enough to buy a Basic Life Package (BLiP). No one sells BLiPs yet, but we think someone should. Here’s what you’d get, 4 years of tuition towards a BS/BA degree, a new car with 10,000 gallons of gas to go with it (or equivalent electricity, if it’s a plug-in), 2 week hospital stay (just in case), and a new house.

The chart shows how long it would take to earn enough to pay for a BLiP if you earned the median pay (50% of earners make more than you, and 50% of earners make less than you), and all of your money went towards paying for it. In 1968 the median pay was $8,630 and it took 2 years and 25 weeks. Despite the fact that median pay in 2008 was 6x higher, at $52,029, it still takes almost 3x longer (7 years and 32 weeks) to pay for a BLiP than in ’68. Because of the modern trend towards financing, the additional earning time required to pay for a BLiP is actually significantly longer than this. Feeling stressed? More time devoted to earning enough to pay for a BLiP means less time for you to be you. Not cool.

As inequality is reduced, pay for the vast majority of people goes up, causing the time required to earn enough for a BliP to go down. If you’re in the top 2%, you may be thinking, “I like the way things are now, and more equal pay means less pay for me”. That thinking, multiplied by many, is what’s helped to bring us the anemic GDP growth we see today.

What happens when you flip that thought to the much cooler, “If people don’t earn enough, then they can’t buy what I’m selling”? That kind of thinking helps to bring us something much closer to the ’68 economy, an expansion that wouldn’t quit. That’s good for business. It’s good for earners. it’s good for you.

Real talk from comedian Will Rogers in the 1920s nailed it this way:

“The money was all appropriated for the top in the hopes that it would trickle down to the needy. President Hoover didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellow’s hands.”

We can’t take you back to ’68. But, if you want to see how much better (or worse) your pay and life in the US could be if we brought the inequality temperature down (or up). Play with the Trickler. Find your ideal tempreature. It let’s you see how your pay, GDP growth, savings rates, drop out rates, homicide rates and democracy all change as earning becomes cooler (more equal) or hotter (less equal).

If you feel the heat, maybe you see the light, and, by now, you may be thinking;

“How can I be cooler?”

Wear shades and walk the talk this way:

1) Push for public policy and candidates who are cooler.

2) Make green choices. that are sustainable. This will keep the temperature down and the biodiversity up.

3) Make blue choices too. By this, we mean, choose the product or service that works for you and produces less inequality for everyone else. So, for example, Pay Day Lenders, some retailers and certain types of credit cards are not blue. Fair Trade, No-Sweatshop goods and services and our own Open Pay are blue. Blue is the new black, and blue action will keep the societal temperature down, grow the economy and improve democracy.

We also want to give a shout out to everyone who is NOT yet earning and wants to be. We know your attitude has changed, and we want you to know you’re not alone. We feel you. Stay strong!

|

hankort

Blue is the new black! RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() RFx140

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

RFx140

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() jfritchman

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

jfritchman

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

![]() staffordmasie

Those DM'ing about @openyear

: Check them out here; http://bit.ly/c8W1Gg

Cool concept re wealth sharing & distribution!

staffordmasie

Those DM'ing about @openyear

: Check them out here; http://bit.ly/c8W1Gg

Cool concept re wealth sharing & distribution!

![]() staffordmasie

Great articles! "How to be Cooler" from @openyear

http://bit.ly/cHbocn

Also see "How to be a Billionaire" http://bit.ly/dkXNMm

staffordmasie

Great articles! "How to be Cooler" from @openyear

http://bit.ly/cHbocn

Also see "How to be a Billionaire" http://bit.ly/dkXNMm

![]() BlackoutINK

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

BlackoutINK

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() CloudCounter

How to be Cooler : Openyear: http://bit.ly/9ywI0c

-As inequality is reduced, pay for the vast majority of people goes

up about

CloudCounter

How to be Cooler : Openyear: http://bit.ly/9ywI0c

-As inequality is reduced, pay for the vast majority of people goes

up about

![]() fergarcia1966

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

fergarcia1966

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() leashless

RT @ikostar:

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

[well that's damn cool - thank you! check this out]

leashless

RT @ikostar:

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

[well that's damn cool - thank you! check this out]

![]() adamdward

Oh man I want to be cooler. Interesting article about pay. Be green

and buy blue : http://bit.ly/9SrpYG

adamdward

Oh man I want to be cooler. Interesting article about pay. Be green

and buy blue : http://bit.ly/9SrpYG

![]() fredbartels

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

fredbartels

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() nitin

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

nitin

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() ntarunkumar

Make green and blue choices - great one! RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

ntarunkumar

Make green and blue choices - great one! RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() theeconomysucks

How to be Cooler : Openyear http://bit.ly/aawirw

theeconomysucks

How to be Cooler : Openyear http://bit.ly/aawirw

![]() danielbrandell

How to be Cooler : Openyear: http://bit.ly/aawirw

danielbrandell

How to be Cooler : Openyear: http://bit.ly/aawirw

![]() dabra

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

dabra

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() cornell2684

There is a parallel between the economy and the seemingly rising

temperatures

http://www.openyear.org/sharing-economy/how-to-be-cooler/

cornell2684

There is a parallel between the economy and the seemingly rising

temperatures

http://www.openyear.org/sharing-economy/how-to-be-cooler/

![]() niklasloven

How to be Cooler : Openyear http://t.co/9tSoshL

niklasloven

How to be Cooler : Openyear http://t.co/9tSoshL

![]() thebuckst0p

Interesting concept of cost of "Basic Life Package (BLiP)"

as economic measure http://bit.ly/caM0U5

thebuckst0p

Interesting concept of cost of "Basic Life Package (BLiP)"

as economic measure http://bit.ly/caM0U5

![]() 9000BC

http://www.openyear.org/sharing-economy/how-to-be-cooler/

be cooler...

9000BC

http://www.openyear.org/sharing-economy/how-to-be-cooler/

be cooler...

![]() Villavelius

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

Villavelius

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() ibnuharis

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

#fb

ibnuharis

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

#fb

![]() smehro

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

smehro

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() dalanhurst

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

dalanhurst

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() felixstang

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

felixstang

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() markus_breuer

How to really be cooler. Great food for thought and great facts and

numbers: http://bit.ly/90v7W8

/via @timoreilly

markus_breuer

How to really be cooler. Great food for thought and great facts and

numbers: http://bit.ly/90v7W8

/via @timoreilly

![]() kalenlee

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

kalenlee

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

grechaw

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() matthunte

RT @carpenterale:

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

matthunte

RT @carpenterale:

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() mariadeathstar

This is an insanely interesting perspective: RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

mariadeathstar

This is an insanely interesting perspective: RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() johnsicat

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

johnsicat

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() jstan

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

: timoreilly: Thought... http://bit.ly/dm5J3X

jstan

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

: timoreilly: Thought... http://bit.ly/dm5J3X

jcoleis

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() ikostar

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

ikostar

@leashless

blip http://www.openyear.org/sharing-economy/how-to-be-cooler/

![]() rberger

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

rberger

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

(via @timoreilly)

![]() claudiaramos

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

claudiaramos

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() _Orwell

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

_Orwell

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

timcohn

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() juanviejo

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

juanviejo

RT @timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() carpenterale

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

carpenterale

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() coldacid

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

coldacid

RT @timoreilly:

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

![]() timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

timoreilly

Thought-provoking piece from @openyear:

How to be cooler http://bit.ly/9SrpYG

How to be a Billionaire

All total, there are 372 billionaires in the US worth about 1.3 trillion all together. That’s the same as 13,146,371 median (those exactly in the middle) net worth families. If you have trouble visualizing $1 billion, take a look at the image below. It’s $1 billion stacked in $100 bills. Each cube is worth $100 million.

courtesy of www.methodshop.com.

courtesy of www.methodshop.com.

Again this year, Bill Gates and Warren Buffett topped the Forbes list of US billionaires. We applaud them, not just because they’re Olympian earners, but also for the enormous good they do through the Bill and Melinda Gates foundation. Combined, they’re worth about $100 billion. Forbes classifies them as “self made” billionaires, as they did not inherit. But we offer an alternate classification, “ earner made”.

Warren Buffett (left) and Bill Gates (right) playing bridge. photo by: Ethan Bloch

What you earn makes consumption of Windows, Coca Cola, Google Ads, or iPhones, by those who depend on you, possible. Billionaires don’t become billionaires based on salary, they earn based on the trickle up of the consumption you enable, combined with ownership of a large percentage of a company’s stock. You turn their genius into wealth.

Why is the Forbe’s billionaires list their most popular piece year in and year out? For some, it’s an occasion to ooooh and aaaah. For others, an occasion to rant against the rich. But, how does it inform or affect the lives of a typical earner, like you? If you’re a golfer, you might study Tiger Woods. For chess, Gary Kasparov. For snow boarding, Shaun White. For earning, why not study billionaires? We thought we’d take a closer look at the self/earner made Forbes data for you to see if there was anything there that could help you become a billionaire.

Option 1. Be in the right place at the right time.

| Otherwise known as, inheriting your wealth. If you can pick your parents well, this is the easiest way to go. But, be forewarned, most billionaires are self/earner made, and those who are have an average net worth of about $3.5 billion, vs. $3 billion for those who inherit. |

Option 2. Be in the right place at the right time with the right action.

In response to the Great Recession, many have called for more education to help prepare earners for new jobs. The Forbes US billionaire data adds color to this generic recommendation. It turns out that amongst billionaires, we notice a freakonomical result. Those with the least formal education, drop outs, have the highest average net worth. Those with the most formal education, PhDs, LLDs and MDs the lowest average net worth. But, there is not quite an inverse relationship between formal education and net worth. Those whose highest degree is either an MBA or MS are greatest in number, and have the second highest average net worth, after drop outs.

Take Away: We think this suggests that billionaires value scarce and timely consumer and market knowledge over academic knowledge, and take action to get it. But, if you’re going to get a degree, get a Masters, preferably an MBA.

For those who complete a formal education, the right places appear to be, by far, Harvard U., followed by Stanford U., Columbia U., MIT, U. of Chicago, U of Penn., NYU, U. of Texas, UC Berkeley and USC. Billionaires graduating from these 10 schools created about 39% of all billionaire wealth.

Apart from what they learn at these institutions, we think one undervalued benefit of graduating from them is the trust these university names engender in potential backers, clients or employers, relative to, say, Wasamata U. This seems to be underscored by their first names too.

The most prominent first names among them are John(17), David(13), Steven(13), George(8), James(7) and Charles(7), primarily biblical names, or names of great historical figures, that people are more inclined to trust. In general, billionaires don’t have unusual first names. Of course, there is the exception, the one and only Oprah. She’s the only US self/earner made woman billionaire, and the only non-Asian minority billionaire. We believe she succeeds in large measure because she’s been able to build trust through her television persona. Otherwise, the self/earner made US billionaire list is more than 97% white male.

Take Away: Your ability to earn rises with how much others trust you. If you don’t have a pedigree from one of the schools listed above, a common biblical or historical first name, or look like a billionaire, you’ll have to take action to cultivate more trust. If you’ll be naming a baby soon, it’s something to consider.

The average age of a self/earner made US billionaire is 66. But the average age varies by industry. It goes from youngest to highest as follows, internet/software (52), investments/finance (64), electronics/semiconductors (65), oil/energy (65), retail/apparel (67), manufacturing (68), media/entertainment (68), and real estate (73).

Together, these 8 industries comprise 64% of self/earner made US billionaire wealth. Setting aside the outlier industries, internet/software and real estate, where average ages are significantly higher or or lower, we see that their birth dates cluster around the end of WWII. They were lucky enough to be born into the greatest economic expansion the US has ever seen. Timing matters.

Take Away: Look to earn and own stock within industries and countries that have the potential for strong growth over the long term. Health, Genomics, Green industries, Space, Internet, China, India and Brazil are all worth considering.

Option 3. Be in the right place at the right time with a nudge.

If you live in Alaska, the Dakotas, Iowa, New Mexico, Louisiana, Mississippi, South Carolina, West Virginia, Delaware, or Maine there are no billionaires living in your state. If you live in any of the others, you have at least 1 billionaire residing in your state.

Let’s say you’re already 66, or are a woman, or didn’t graduate from a premiere school, or your first name is Osama, or you don’t have a head for business, then what? Well, click on the adjacent billionaire map. Find your state. Click on the white billionaire icon. See the list of billionaires living in your town. If you happen to run into them at an airport, restaurant, spa or wherever, very politely nudge them to open their earning to the earners that put them where they are using Open Pay, or the service of their choice. This means reserving a % of their earning for distribution to earners in the bottom 99% based on their influence on them. This won’t make you a billionaire, but it will help make trickle down a reality.

Billionaires are like everyone else, they may know the right thing to do intellectually, but to get them to actually do it, takes nudging.

Chances are your local billionaire already has a favored philanthropy. Point out that opening his pay will very likely help him to achieve his philanthropic goals faster. Using the Gates Foundation, as an example, epidemiological research shows that 40% of the problem areas on which they’re focused are, themselves, exacerbated by gross inequality, itself. The adjacent table shows the match up.

| Gates Foundation Problem Focus | Problems Worsened by Inequality |

| nutrition, pneumonia, HIV/AIDS | physical health |

| tobacco | drug abuse |

| early learning, high schools | education |

| financial services for poor | social mobility |

| family planning | teenage births |

| maternal, newborn and child health | child welll being |

Let your local billionaire know that the middle class is hurting, and they have a responsibility not just to the poor, but also to the middle, who put them where they are. To paraphrase Warren Buffett, “If you’re in the luckiest 1 per cent of humanity, you owe it to the rest of humanity to act on behalf of the other 99 percent.”

Comments

-

How to be a billionaire Step 1 - either drop our of school or get an MBA (or pick billionaire parents): http://bit.ly/9pQ8Xv

-

nice overview: boils down to right place, right time (luck) RT @ jhagel: How to be a billionaire - interesting analysis http://bit.ly/9pQ8Xv

-

How to be a billionaire - interesting analysis http://bit.ly/99w9Nf

-

HT. Neal Kohl...Worth the read on openyear.org. http://bit.ly/99w9Nf

X Jobs

Both Robert Reich and Leo Hindery are among the few speaking up to make sure the economy works for you! Outspoken and smart, they’re also very cool, with Leo and his crew winning at Le Mans in 2005, and Robert, more recently, making his hilarious comedy debut with the help of Conan O’Brien.

Unlike the vast majority of people you hear speaking on the economy, they put earners first – with a laser focus on jobs. They get that growth depends on fair distribution of pay.

Listen to how they kept it real, as Leo was interviewed, independently, on the Leonard Lopate Show out of NYC, and Robert was interviewed on the Michael Krasny Show out of SF.

|

Leo Hindery |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Leo points out that real unemployment in the US is at 20%. The average full time earner only works 33 hours. |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Leo’s turnaround plan calls for large scale infrastructure investment, youth employment and buying domestically to create jobs in the US. |

|

Robert Reich |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Robert breaks down the various economic factors contributing to consumer (earner) trauma. |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Robert says 23.5 % of pay goes to top 1%. Up from 9% of pay in the 1980s. This is a structural problem that’s been building for years, only now made visible by the Great Recession. |

|

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser. |

Robert’s turnaround plan calls for a large second stimulus, resurrection of the WPA, and investments in education, particularly at the community college level. Note: listen closely to the Ivy League/UC Berkeley educated MBA living on 20% unemployment at the start of the clip. More on that later. |

They both agree that the numbers of people in the US out of work is so great (11 million+), that neither the Federal stimulus, nor any bills proposed, are large enough to get everyone back to work. Just like when you need more acceleration to pass the motorist in front of you, they’re calling for more stimulus so we can accelerate through the Great Recession faster, and return to propserity. But, the highway to a second stimulus bill may be closed when we have US Senators blocking the, far less costly, simple extension of unemployment benefits with road signs that say, “tough shit“.

When we’re 11 million jobs in the hole, and we need to create 1.5 million jobs each year, just to keep pace with population growth, we need a Plan B. When unemployment is at roughly 10%, and is projected to remain at 8% until 2014, we need a Plan B.

We need a plan B.

At the start of the third Reich audio clip, you’ll hear an Ivy League/UC Berekely educated MBA, living on unemployment, at 20% of his normal earning. He testifies as to how hard he’s trying to find work, and how little he likes being on the dole. He’s smart. He’s educated. He’s out of work. Why, when education is often given as the key to avoiding unemployment, are so may well educated people unemployed? We offer 3 reasons.

Earners can’t properly plan.

While we can have some idea of what the price and availability of oil, or soybeans will be in a year, thanks to future’s markets; we can’t do so with MBAs or janitors. Odds on every legitimate sporting event are forecast. Weather is forecast and broadcast. Corporate earnings are forecast and broadcast. But, for the most crucial economic indicator in your life, your future earnings, there’s NO forecast!

You can’t blame companies. Chances are they know of potential layoffs long before you do. But, it’s in their best interest to keep the information secret as long as possible, so as to not impair productivity, or trigger an exodus of their best people. If earners want to be able to plan smooth transitions, as companies do, then they”ll need earning forecasting, by occupation and locality. Odds are, they’ll have to build the forecasting system themselves and feed it data too, because no one else will be motivated to do it.

Earners weren’t properly prepared for the future.

Academic degrees have their historical roots in medieval trade guilds, where the emphasis was placed on trade mastery. The top 10 in demand jobs of 2010 did not exist in 2004. This accelerated rate of change means the most important subject to master is the future. We must work backwards from the future, to anticipate problems and jobs that don’t yet exist.

Money that could be used to pay earners is wasted because it’s not time leveraged.

When “An ounce of prevention is worth a pound of cure.” meets “Where’s the pain?”, “Where’s the pain?” usually wins. So, expensive ER and “heroic” medicine prevails over wellness. $23K on average is spent per prisoner vs. $10K per student. And, to quote former US Treasury Secretary, Hank Paulson, “It’s very difficult to get Congress to act on anything that is big and complex and controversial if there is not an immediate crisis”

Given the average cost to educate a student, and the average cost to incarcerate a prisoner, on a GDP basis, we’re better off with more prisoners. Quantitatively this makes sense. But, qualitatively, we know it does not.

It is, in part, because we fail to use qualitative measures that the US economy is rampant with money wasted on later stage crises, that could be use to pay earners; if only it were profitably leveraged at the beginning to reduce the risks in the first place. More teachers are a qualitatively better use of money than more prison guards.

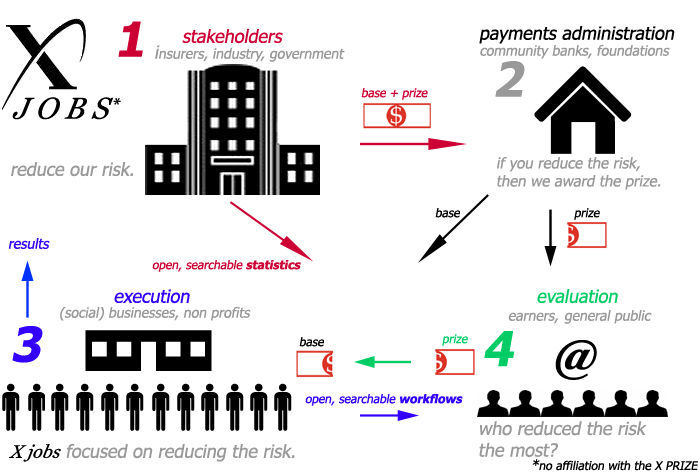

Which brings us to X Jobs. You may be familiar with the X Prize, whose mission is to “create radical breakthroughs for the benefit of humanity thereby inspiring the formation of new industries, jobs and the revitalization of markets that are currently stuck”. They’ve opened the door to a new industry of space tourism through the Ansari X Prize, won by SpaceShipOne. Basically, they offer a $10M prize for any group that is able to achieve a breakthrough, the specifics of which, are layed out by the sponsors of the prize.

X Jobs would follow a similar line, except that rather than emphasize narrowly focused breakthroughs, that typically favor small groups of high earning PhDs, X Jobs would emphasize broad societal risks, that favor large groups of average earners.

For example, car crashes kill about 44K people per year, making it the 6th leading cause of death in the US. About 1/3 of those deaths are caused by drunk driving. The cost to motorists is about $160B per year in lost life, property damage, lost earnings, medical costs and so on. If even a small fraction of this many people were killed in a terrorist attack, we would move heaven and earth to prevent it. But, for some reason, we tolerate these deaths, which occur reliably, like the sunrise, year in and year out.

Let’s take a look at how X Jobs might work for car crashes.

1 Stakeholders: Insurers are paying life insurance, disability, medical costs and property damage claims. Counties and municipalities are paying for medical costs and clean up. Industries are paying with lost earners and lost productivity. These and other crash related costs amount to $160B.

Stakeholders sponsor a prize valued at 5% of what they’re spending now on crashes, in exchange for a 10% reduction in collisions in the succeeding year(s). This amounts to an $8B prize, equivalent to about 3 1/2% of the stimulus at its peak. Essentially, stakeholders would receive a $16B reduction in costs, in return for $8B, or a 100% return on their money.

50% ($4B) of the money is paid out immediately in base pay to fund the effort. 50% is withheld as a prize, only to be awarded, if the reduction is achieved. Sponsors risk a potential loss of $4B, against a potential gain of $8B, should the goal be met.

Open Data: the sponsors also agree to share relevant, real time statistics, such as when, and where collisions occur with evaluators as soon as the data is available.

2 Payments Administration: Unlike the X Prize, X Jobs have many potential winners. Community banks and Foundations with local knowledge act as fiduciaries. They process applications for funding from (social) businesses and non-profits. They administer payments and contribute their knowledge where useful. For this, they take a 5% fee, leaving $7.6B.

3 Execution: Businesses, non-profits like Mother’s Against Drunk Driving and new organizations formed to meet the challenge, apply for and receive base payments. They set about reducing collisions by any legal means necessary. If that means parking outside the bars and clubs at 3AM and offering free rides, that’s what they’ll do. To persuade evaluators that their efforts are more prize worthy than others, they can choose to make what they do transparent and searchable. Openyear can help with that. So, for example, club-to-destination-zip-code GPS record of each drunk person driven home from the club would count in their favor.

4 Evaluation: Earners and the public who are not affiliated with sponsorship, administration or execution are invited to be prize judges. Over the course of the year(s), they follow what people are doing and how the statistics are changing to reach consensus on which organizations/persons are contributing the most towards the overall goal of reducing crashes. The prize (bonus) is awarded to organizations/earners by the Payment Administrator based on their decisions.

If we subtract 1/3 ($2.53B) for execution infrastructure and dedicate the rest to earners, this creates slightly over 100K, $50K jobs. Not much, given how far we are in the hole. But, when you add up all the societal risks we know of that we could tackle with the X jobs model, it easily exceeds the stimulus in sheer dollars. What’s more, it shifts the focus towards where to spend to get the most leverage – biggest bang for the buck – rather than simply levels of spending.

When Eisenhower was US President, we built Interstate Highway infrastructure to better move goods from the State to State. It worked. The US grew. By comparison, the X Jobs infrastructure to move money and information between entities is trivial. Many economists are saying that the US is moving into a permanent condition of high employment. This doesn’t have to be. Reich and Hindery have sounded the alarm. What are we going to do? People dying on the roads and suffering from unemployment can’t wait for Congress. We need a Plan B, and we need it now. We need X Jobs. If you’re feeling us, contact us at info@openyear.org, or sign up at right.

More Tax or Less Tax?

February 13, 2010 by Openyear

Filed under Super Earners

In representative democracies, tax policy, and public policy, generally, are a function of opinion and partisan control of government.where O is opinion and I is partisan control of government. According to a CBS News opinion poll, 74% of US earners support higher taxes on super earners to redress inequality. Financial Times / Harris polling shows similar sentiment for the UK (56%), France(51%), Italy(59%), Spain(65%), Germany(64%), China(60%) and Japan(77%). US top tax rates are near historic lows. Given historical cyclicality - the Great Recession and war - the Federal deficit, and the mood amongst the earning public, top tax rates are very likely to rise. Only 1 question remains: What's the most important action you can take to mitigate the rise? Action 1: Influence partisan control. Contribute to the political party or candidate of your choice. Efficacy: Reversible change. Whatever your party achieves today can be undone tomorrow by the next party in power. Breadth of change is limited to your country. Action 2: Influence opinion. Contribute a recommended minimum 3% of your pay to the earning public using Open Pay. Efficacy: Permanent change. Like Facebook's shifting of attitudes towards privacy, Open Pay shifts attitudes towards inequality and the need for increased taxes on super earners like you. Breadth of change spans the globe.

Action 2 makes trickle down REAL for earners. Either action is tax deductible in the US. But, only action 2 enhances your reputation for social responsibility, improves the economy, and helps ameliorate many social ills like violence, lack of trust and mental illness, which all rise in proportion to inequality. Action 2 is preemptive, strategic and 4X as efficient as taxation at reducing inequality by putting money directly into earner's pockets based on merit (relative person to person influence). So, it will mean less less taxation for you in the years to come. Chances are you've tried action 1, and observed, first hand, the limits of partisanship. Instead, why not gain instant street credibility with earners, and dampen the call for higher taxes by opening your pay? Maximize your impact on the world by joining your super earning peers in explosive action that gives you the biggest bang for the buck, for only slightly more than what you're probably donating, on average, to charity today. Last, but not least, action 2 feels better than action 1. So, feel better and sign up!

Class Cooperation. Not Class Warfare.

January 25, 2010 by Openyear

Filed under Super Earners

If you earn more then $325K in the US, you’re in the top 1% of all earners. You’re a super earner. Chances are you own a business, manage a business or have a great portfolio. You depend on your business. Your business depends on consumers. Consumers depend on earners.

When earning isn’t well distributed, consumers lean on credit. When credit runs out, consumers can’t buy what you’re selling. The economy stalls. This is where we are now. What’s the way back? Balance has to be restored. Goldman Sachs knows it. They’re looking for an alternative to increased taxation. That’s why they’re considering enforcing a requirement that all their executives donate 4% of their bonuses to charity. Here at Openyear, we’re asking you to consider donating 3% of your income to the bottom 99% to help reduce inequality. We call it Open Pay. Open Pay distributes pay based on relative person to person influence. With respect to reducing inequality, Open Pay is 4X more efficient than taxation. Take a look at our 5 reasons to open your pay here, or read on to learn why we think Open Pay is, arguably, the best use of your charitable dollar.

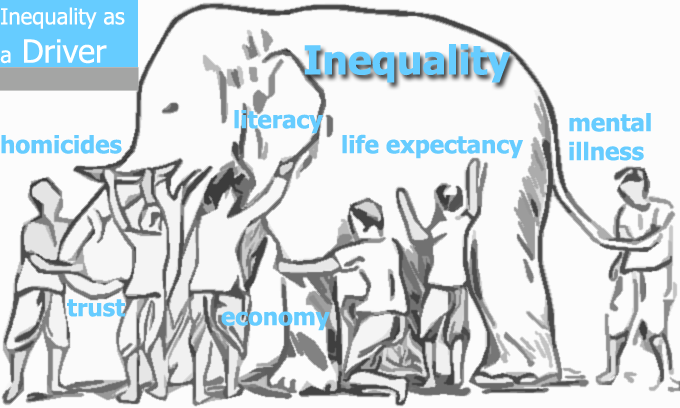

You probably think in terms of drivers. If a ship is sinking, bailing is essential, but fixing the driver, the leak, is critical. Epidemeologists have recently identified inequality, itself, as a driver of many of society’s problems – from lack of trust to violence and imprisonment.

If you have an interest in any of these problems, you can address each issue one at a time. Or, more productively, address then all in one action, by focusing squarely on inequality.

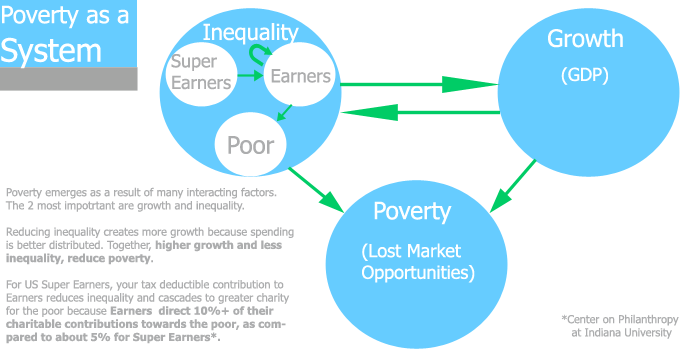

Super Earners have asked us the question, “I see how this can help the middle, but what about the poor?” Poverty can be understood as a system. Its 2 most important drivers are growth and inequality. The size of the pie, as measured by GDP, gets lots of attention. But what about it’s counterpart – how the pie gets sliced – as measured by the Gini Index – it gets far less attention. But, it’s the elephant in the room.

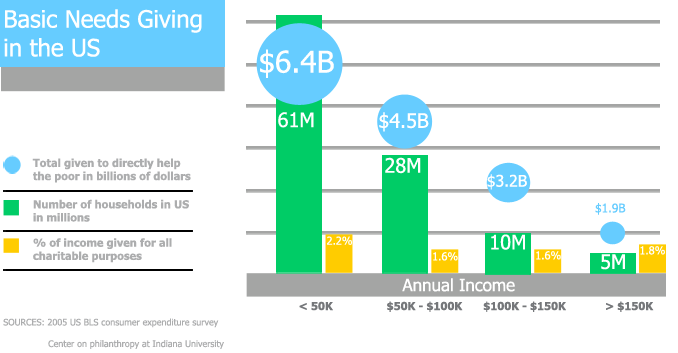

Your charitable contribution to Open Pay goes directly to earners in the bottom 99%. 90% of all earners in the US make less than $100K. This $100K and under earner group gives, on average, 2.2% of their income to charity, as compared to 1.8% for super earners. Since 10%+ of what they give goes towards the basic needs of the poorest, as compared to about 5% for super earners,

Open Pay, enables you to strengthen the middle, and that helps cascade giving to the poor. Consider that people in the middle probably know more poor people than you do, and leverage their domain expertise. Class cooperation. Not class warfare.

You value your time. You value your effectiveness. We challenge you to consider what other single action you can take that helps to improve both society and markets at the same time. Why wait for higher taxation, when you can demonstrate leadership now on an alternative approach to ameliorating inequality, that puts money directly into people’s pockets based on merit ? Please consider Open Pay today, your staff and the public will love you for it!

Move Your Money

|

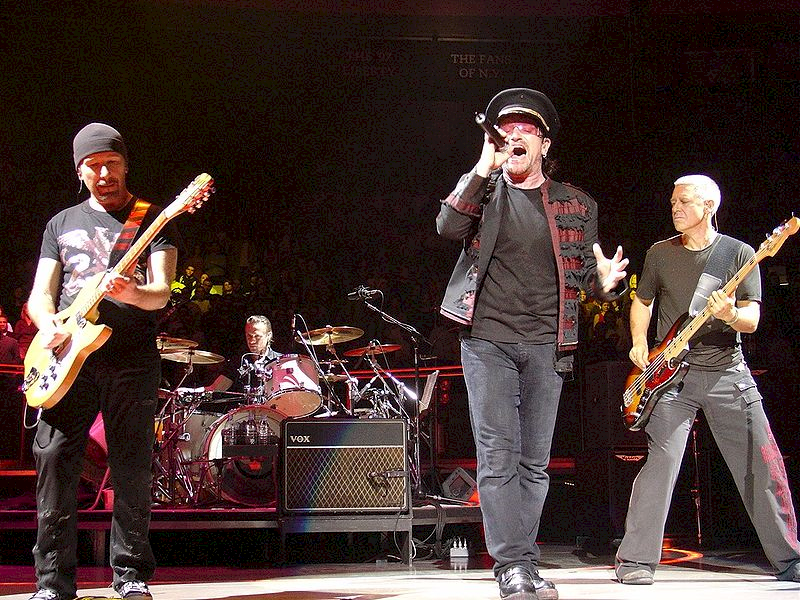

U2’s front man, Bono, points to People Power and the Upside-Down Pyramid as one of the big ideas that’s going to make the next 10 years more interesting. He says, “Increasingly, the masses are sitting at the top, and their weight, via cellphones, the Web and the civil society and democracy these technologies can promote, is being felt by those who have traditionally held power.” Or, as the band has paraphrased lyrically, from their song Silver and Gold, |

Captains and Kings in the ship’s hold

They came to collect

Silver and gold, silver and gold.

I seen the coming and the going

Seen the captains and the Kings.

Seen their navy blue uniforms

Seen them bright and shiny things, bright and shiny things.

The temperature is rising

The fever white hot

Mister I ain’t got nothing

But it’s more than you’ve got

These chains no longer bind me

Nor the shackles at my feet

Outside are the prisoners

Inside the free (set them free).

A prize fighter in a corner is told

Hit where it hurts – For Silver and Gold

You can stop the world from turning around

You just gotta pay a penny in the pound.

We don’t know if blogger Arianna Huffington, film maker Eugene Jarecki, and financier Robert Johnson were listening to Silver and Gold when they hatched their plan for the Move Your Money movement, but they’ve given life to the lyric.

Frustrated with the lack of financial reform of the banking system, and the lack of remorse from the big bankers that brought on the Great Recession, they’re encouraging people in the US to vote with their dollars, and move their money from large banks to community banks to better support their communities. Whether in a large bank or small bank, your money is equally safe because FDIC insures all accounts up to $250K. But, still, you may be wondering, “why should I bother”?

The official Move Your Money video below uses the 1946 film, “It’s a Wonderful Life” to explain why moving your money matters. It’ also happens to be one of our favorite films, so much so, that we ‘ve used it in our Open Pay video (at right).

To the reasons already offered to make the move, we’d like to offer a couple of our own. First, if you’re credit worthy and can’t get a mortgage, car or business loan, you may want to think of access to credit as a pright – a right provisioned as a product.

Your community bank likely makes most of its money on straight forward loans that they, themselves, hold, not on opaque derivatives trading, as many large banks do. So, your small act(s) of moving dollars to them, helps provision a pright to credit within your community more reliably than voting for a candidate who promises the same.

Second, think about what bankers in your community earn, relative to bankers at large banks. Chances are it’s a number considerably closer to what you earn yourself. Your small act(s) strengthens their position and reduces inequality – shown to weaken the economy overall and is the source of many social problems.

If, like us, you’re looking for the Big Plus over the next 10 years, rather than a repeat of the Big Zero (no job creation – no home appreciation -no stock market gains) that we’ve had over the last 10, ask your self this question, “Is my purchase, support or other economic acts going to send money upwards or pull it down?” Moving your money to a community bank is a great way to pull it down. It keeps your money circulating where you live – to better benefit your family, friends and neighbors.

If you want more info, you can watch Robert Johnson explain on Democracy Now how Move Your Money got going. And, remember, the economy exists to serve U 2. It’s not just the GDP, it’s the Gini. Or, in other words, it’s not just the size of the pie that counts, it’s also how the pie gets sliced which keeps us all well!

Small Actions and the Big Zero

December 30, 2009 by Openyear

Filed under Sharing Economy

According to Nobel winning economist Paul Krugman, the last decade in the USA, amounted to no job creation, no gains for homeowners and no gains in the stock market. In economic terms, the decade was a Big Zero.

What Krugman failed to say in his NY Times Op-Ed, but has emphasized on earlier occasions (watch the video for details), is that the fatal weakness in the USA economy, for decades, has been income inequality. Lack of income means lack of purchasing power, and it’s the purchasing power that creates the markets that keep the economy going. It’s been the chronic substitution of credit/debt for fair earning that has eroded our economy, and brought on the Great Recession.

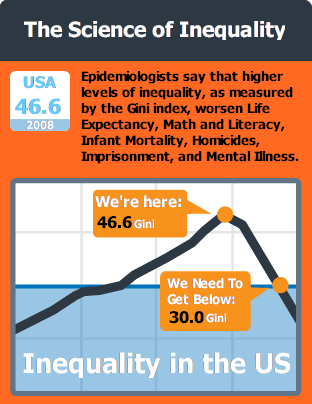

Well, as it turns out, research done by epidemiologists Richard Wilkinson and Kate Pickett show that inequality is also a fatal weakness in societies.

Using the Gini index as a measure for inequality – a Gini of 100 equates to 1 person having all the income and everyone else having none – a Gini of 0 equates to everyone having the same income, Wilkinson and Pickett have found that countries with higher inequality (Gini) all do worse across many societal vital signs. Ginis for some selected countries are as follows: France = 28, India = 36.8, China = 46.9, Brazil = 56.7. You can check the level of inequality for your country on Wikipedia.

Rising inequality worsens Life Expectancy, Math and Literacy, Infant Mortality, Homicides, Imprisonment, Teenage Births, Trust, Obesity, Mental Illness (including drug abuse) and Social Mobility. With a Gini of 46.6, the US scores poorly and, in some cases, off the charts in all of these areas. Think of the resulting transformation, if a portion of all the money diluted attacking these as separate problems at the end, was instead focused on the single purpose of reducing inequality at the beginning! We’re working on opening pay to help with that. Watch the video below to see how Wilkinson and Pickett break it down.

If you want more, and will be in the USA in January, they’ll be on book tour for The Spirit Level: Why Greater Equality Makes Societies Stronger in Atlanta, SF, Seattle, Chicago, NY and DC.

Prights: Rights Delivered as Products

November 3, 2009 by Openyear

Filed under Sharing Economy

Take a minute and listen to US President FDR calling for an Economic Bill of Rights in 1944 to provide prosperity and security for all. It’s refreshing and inspiring. Unlike most people in government today, he speaks plainly, forthrightly and without qualifiers. The first, and most important, right he calls for is “The right to a useful and renumerative job that earns one enough to pay for food, clothing and recreation”. He also calls for ” Rights to decent housing, medical care and education”.

The bulk of the economic rights FDR called for seem less likely to be delivered by most governments today than in his time. Declarations of rights often require foresight and courage. But, that’s the easy part. The hard part is provisioning the right in the real world so that people can actually take advantage of it.

In the 65 years since FDR’s call, many millions of products have been delivered by companies. Some of these products, especially in the last 8 years, have become ubiquitous and mostly free. They’ve essentially made certain rights real in practice. All they lack is a legal declaration. We call these “product rights”, or prights. Some examples follow:

| Product | Right |

| Skype | The right to talk to anyone anywhere. |

| OpenPGP |

The right to private digital communication. |

| MIT Open Courseware |

The right to a world class undergraduate curriculum. |

| Google Books |

The right to access the world’s largest library. |

| Grameen Bank |

The right to entrepreneurial capital at reasonable rates. |

Of course, most of these prights, in turn, depend upon one having a broadband connection. Which, itself, has been declared a human right in France and a legal right in Finland. We see these declarations by France and Finland as excellent examples of polivation; smart public policy that drives innovation to benefit everyone. We predict that a right to bandwidth will spread globally in the years to come, as policy makers understand that access to bandwidth underpins many of the prights which their people want.

We’ve noticed that the difference between a right and a wrong, or a pright and a prong comes down to how things get shared. So, for example, the pright, Grameen Bank, emphasizes relationship and charges a reasonable interest rate for a loan. By contrast, the prong, Pay Day lenders, often charge triple digit interest, resulting in earners at the low end transferring many multiples of what they’ve borrowed upwards. When FDR speaks of a “useful and renumerative job that earns one enough to pay for food, clothing and recreation”, he’s speaking about a pright dynamic.

What happens when sharing is built into earning, like interest is built into lending? Would that help shift us from a debt economy to a sharing economy faster? What happens when datapoints provided by you are used to continuously and automatically discover, plan or create your next job (or education), so your livelihood is never interrupted? Would that help make the economy more stable?

Prights such as these help move the world closer to FDR’s vision. But, there’s no formal mechanism like political parties and voting by which we can call for them. So, if you like prights, support them with at least the same enthusiasm you may have given Obama or McCain; because the global constitution is being written in code (software), and we need a global Bill of Prights to go with it.

EARNDEX

October 25, 2009 by Openyear

Filed under Sharing Economy

Both the New York Times and Google News, 2 of the leading sources of news on the web, prioritize their top news categories similarly, as follows: World, US, Business, Sci/Tech, Sports and Entertainment. Arguably, 2 thirds of these categories (Business, Sci/Tech, Sports and Entertainment) make implicit calls to consumption; either in the content, or through surrounding ads. Whether it be the purchase of financial services, gadgets, tickets to sporting events or the latest video games, the framing of the news favors consumption.

But, what about the other side of the ledger? Where are the (sub) categories that implicitly speak to the earning (or lack of it) that makes the consumption possible in the first place?

It got us thinking, “if stock indexes are great for giving the investor a heads up, why not an earner index, or EARNDEX, that gives earners a heads up, by tracking categories of interest to earners, or those who aspire to be earners”. EARNDEX tracks categories such as ‘joblessness’, ‘middle class’, ‘poor’, ‘top 1%’, ‘wealth sharing’, ‘wealth gap’ and so forth that get at the life long challenge of earning.

The news cycle drives the economic and political cycles. Each day, EARNDEX allows you to see the % of the news cycle devoted to a given category relative to the others. So, for example, we’ve observed that the top 1% and the poor routinely get more coverage than the middle class. You can also see how news share for each of the categories compares from week to week. Use EARNDEX to stay informed on the news that matters most to your livelihood.

We’ve been following Michael Moore, and while we don’t agree with him on everything – for example, we believe capitalism itself is not the problem, but rather the problem is parasitic business cultures that have forgotten how to be symbiotic – we thought he kept it real when he was interviewed on Democracy Now. Take a look.

How to be a billionaire? Got an MBA & MS from the "right" schools. Too bad I am not a white male with a biblical name