Economist Robert Shiller’s Openyear Interview

January 9, 2009 by Openyear

Filed under Sharing Economy

Journalist Mitch Ratcliffe spoke with economist Robert Shiller in an Openyear sponsored interview on some of his ideas put forth in his seminal book,The New Financial Order. In it, he says that finance should serve people directly to help reduce their risks, not just remain a tool of business.

Journalist Mitch Ratcliffe spoke with economist Robert Shiller in an Openyear sponsored interview on some of his ideas put forth in his seminal book,The New Financial Order. In it, he says that finance should serve people directly to help reduce their risks, not just remain a tool of business.

He foresaw the internet and housing bubbles first, and coined the term irrational exuberance. He has proposed innovative tax policy to help reduce US inequality.

Here is some of what he and Mitch discussed.

Humans are the most important part of the economy.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

Livelihood Insurance is extremely important to our development.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

Unions should think creatively about uncertainty and find risk solutions.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

People will share their future upside income for support early on.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

We haven’t allowed human capital to be risk managed as financial capital has. It needs to be democratized.

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

Actor James Gandolfini opened his pay to other actors on the Sopranos.

January 6, 2009 by Openyear

Filed under Super Earners

Comments Off on Actor James Gandolfini opened his pay to other actors on the Sopranos.

After 4 seasons starring in the HBO series The Sopranos super earner actor James Gandolfini decided it was time for a change.

In the series, he played a NJ mobster in therapy, Tony Soprano, pursuing the conflicting goals of maintaining tranquility at home, while simultaneously managing his crew of earner-mobsters in their illicit activities.

The 5th season was delayed while James and HBO sparred over his contract. James sought to more than double his pay. He understood that as the star, he couldn’t be written out of the show like others in the cast, so he was in a strong negotiating position. He held out. Fears mounted that the show would be canceled. But, in the end, they came to an agreement.

So, what did James do with some of his extra pay? He opened it up.

He wrote checks to his fellow actors, amounting to a significant percentage of his pay, to acknowledge that together, as an ensemble, they made the show great!

By its very nature, his contract negotiations with HBO were closed to others. It was all about him. But, he chose to make the gain all about them.

Together, the financially fortified ensemble of that 5th season went on to contribute to The Sopranos becoming the first cable show to ever win an Emmy award for Best Drama Series.

Together, the financially fortified ensemble of that 5th season went on to contribute to The Sopranos becoming the first cable show to ever win an Emmy award for Best Drama Series.

CEO Sam Palmisano opened his pay to encourage teamwork at IBM.

January 6, 2009 by Openyear

Filed under Super Earners

Comments Off on CEO Sam Palmisano opened his pay to encourage teamwork at IBM.

Fortune 500 CEO compensation contracts are typically closed to outsiders. That is, their contracts typically benefit them as individuals, and no one else. Like all other Fortune 500 super earner CEOs, Sam Palmisano, CEO of IBM, had such a contract.

But, Sam had a problem. The various division heads of IBM sometimes pursued their own results at the expense of IBM as a whole. Shifting his management team’s emphasis from me to we was a prerequisite for getting the best over all results for IBM. How to do it?

Sam’s answer was to break the CEO mold by choosing to open his pay. He requested that IBM’s Board of Directors vote in favor of making a substantial percentage of his pay available to incentivize his direct reports to work together. Results? Sam’s action helped bring the team out of them, which contributed to IBM returning a record $8 billion to investors.

Actor Keanu Reeves opened his pay to the crew on the Matrix movie.

January 3, 2009 by Openyear

Filed under Super Earners

Comments Off on Actor Keanu Reeves opened his pay to the crew on the Matrix movie.

Like many A-list Hollywood super earner actors, Keanu Reeves has the leverage to negotiate a contact that gives him a percentage of profits from films he stars in, as he did in The Matrix.

In the movie, Keanu plays Neo , a happy earner, who discovers that his happy life is an illusion simulated by machines – who have supplanted humans to become the dominant lifeform. He’s given the choice to remain in the illusion, or to perceive the world as it truly is.

Unlike many A-list actors, whose contracts are closed to outsiders, Keanu decided to change his contract so he could open his pay to the crew that would produce the sequels The Matrix Reloaded and The Matrix Revolutions. He chose to set aside a percentage of his upside to benefit the crew who lacked the power to negotiate for a slice of profits. As he put it:

“What I did was I put part of what was given in my contract to create a pool so that other people who don’t usually do profit participation could see some money.”

So, what was the result? When Keanu opened his pay to the crew, – he shifted the focus from me to we – this helped propel The Matrix Reloaded to the second highest grossing R rated film of all time.

So, what was the result? When Keanu opened his pay to the crew, – he shifted the focus from me to we – this helped propel The Matrix Reloaded to the second highest grossing R rated film of all time.

Sharing the Wealth is Good for Everybody

January 2, 2009 by Openyear

Filed under Sharing Economy

During the 2008 Presidential campaign Barack Obama spoke with a plumber named Joe in Ohio about his tax plan. Here’s how it went.

Obama points out to Joe the plumber that “spreading the wealth around is good for everybody”.

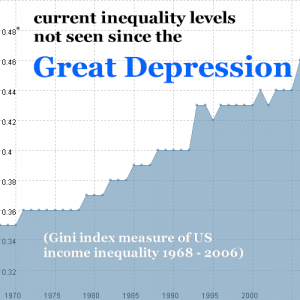

Why did he say this? Perhaps, he is familiar with the history of the Great Depression. Mariner S. Eccles, FDR’s Fed Chariman from 1931-34 concluded in his book, Beckoning Frontiers: Public and Personal Recollections, that inequality was the main cause of the Depression. Mariner put it as follows:

“A giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth.”

“A giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth.”

“The United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out the game will stop.â€

In other words, if earning is not well distributed, the economy stalls, because people lack the purchasing power to keep it going.

Inequality has also been shown to shorten life expectancy for those in the bottom 80%, with the difference between super earners and earners amounting to about 2 years on average. While it may not seem like much, this is equal to the gain in life expectancy society would receive if cancer were cured, as Larry Summers explains below:

Obama’s rival John Mccain later responded in a radio address with:

“As Joe the Plumber has now reminded us all, America didn’t become the greatest nation on earth by letting government “spread the wealth around.” In this country, we believe in spreading opportunity.”

Both McCain and Obama are right. But, it begs the question, Why isn’t opportunity itself spreading the wealth as well as it once did?

Like global warming, the root cause comes down to the economy not fully accounting for the consequences of what we do. In the case of global warming, the harm that invisible carbon gases do has remained economically invisible, because we’ve failed to price it. Out of price. Out of mind.

As essential as carbon is to life, influence is just as essential to work life. Like carbon gas, influence is economically invisible.

Skill or know how, is visible in the form of diplomas, degrees and resumes. So, salaries tend to be set by visibles, like skill scarcity. But, know how is only half of how we earn. There’s also know who, know what, know when and know where passing between people, or influence.

Because skill is embodied in a single person, it is atomic and individuated. By extension, closed pay approaches based on skill , exclude others, are 1-way and tend to concentrate more money in fewer hands. In contrast to skill, influence is social evidence that no one does it all alone. By extension, open pay approaches based on influence include others, are multi-way and distributive, and place more money in more hands.

In the same way that governments do not expect to solve the problem of global warming alone, but instead rely on companies pioneering green technologies, neither can governments solve the problem of inequality alone. Like global warming, it’s too big.

But, together we can reduce it, by choosing to, open our pay to one another. With your permission, Openyear can help to make influences between us visible, so that how we’re paid better reflects what we do

with the opportunities we get.